Changes in North Korea’s Financial System in the Kim Jong-un Era

- Special Report

- March 25, 2022

- Minjung KIM

- Economist at the Bank of Korea

The following Research Review contains a summary of the article “Changes in North Korea’s Financial System During the Kim Jong Un Era: Based on North Korean Literature,” co-authored by Minjung Kim and Sung Min Moon of the Bank of Korea. In this Research Review, Minjung Kim, an economist in the Economic Research Institute at Bank of Korea, discusses how financial reforms enacted under Kim Jong-un’s rule are especially of significance compared to past reforms. Not only have recent reforms led practical changes in the organization and functions of central bank, but they have also encouraged greater use of "cash," opposed to "non-cash," through the introduction of the Hyeongeum-donjari (cash account) system. While such reforms have allowed for the implementation of market economy features, the author notes that they have had limited effects in inducing the growth of the financial system.

The Kim Jong-un Era: Progressive Changes in North Korea’s Financial System

Since Kim Jong-un came to power in 2012, North Korea sought to implement changes by introducing elements of market economy. Among them, many changes pertained to the financial sector. For example, there were many changes in the banking system and methods of money circulation and payment. Following the amendment of the Central Banking Act and the Commercial Banking Act in 2015, residents were encouraged to use electronic payment cards. This also allowed companies to create Hyeongeum-Donjari.[1]

In the past, North Korea had introduced features of market economy in its planned economy, including the financial sector.[2] One of the most remarkable changes was the “July 1st Economic Adjustment Measures” in 2002. Fixed state prices were raised to near-market prices. Business accountability was expanded to enhance corporate autonomy and management responsibility. An “income index” was introduced to make evaluations based on profit instead of planned volume. For North Korea, these were drastic measures of reform. Furthermore, in 2004 and 2006, the Central Banking Act and Commercial Banking Act were respectively enacted. Changes were made to financial factors, such as limited approval of cash transactions in the production goods market. Despite such significant reforms in the past, there are two reasons why recent changes in North Korea’s financial system are especially noteworthy.

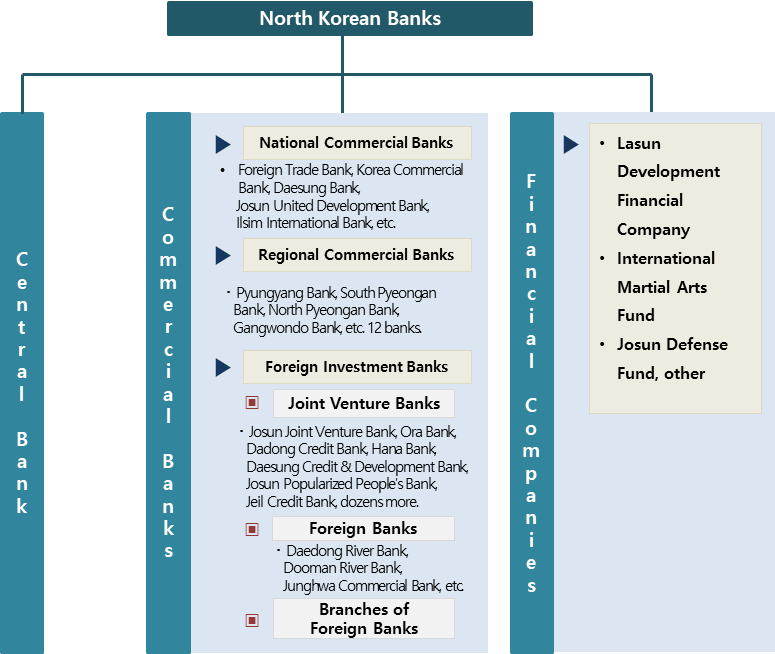

First, unlike previous reforms, the North Korean banking system has seen practical changes involving organizational and functional adjustments. Although North Korea enacted the Central Banking Act and Commercial Banking Act early on, it was not easy to ascertain the actual realities of commercial banks. The organization and function of central and commercial banks remained conjoined, which subsequently invalidated the banking acts. In contrast, we can now confirm that the central and commercial banks are organizationally and functionally separated in the recent North Korean banking system. According to the “Investment Guide to the Democratic People’s Republic of Korea” published in 2016 by North Korea, its banking system consists of central banks, commercial banks, and financial corporations. In addition, the “Issue and Monetary Control Methodology,” published in 2019 in North Korea, specifies that the central bank oversees issuing notes, while commercial banks perform deposit and loan services for corporates and residents. When taking all of these into account, the North Korean banking system has separated the organizations and functions of the central bank and commercial banks and transformed into a two-tier banking system.[3]

Second, the distinctions between “cash” and “non-cash” are no longer as clear. This distinction is a unique structure of money distribution in a socialist planned economy. In a socialist planned economy, residents are limited to using “cash” payments while corporations are to use “non-cash” methods as modes of payment. The most prominent feature of “non-cash” is that it has no real purchasing power as it can only be settled according to a set production plan and price; it therefore, is in reality “passive money.” This contrasts to “active money” that has real purchasing power. In the past, North Korean corporates were only allowed to pay through “non-cash” means that had no actual purchasing power; the possession and use of cash were limited to a specific purpose, such as the payment of laborers’ monthly wages. During the Kim Jong-un era, however, Hyeongeum-Donjari (i.e. checking accounts) were newly established. Companies could withdraw cash and use it for payment or send money through these accounts. Accordingly, “non-cash” now functions as currency and is given some purchasing power. This is a significant change in that price liberalization has expanded and been applied in transactions between companies.

In summary, we can evaluate that there has been a high level of reform under Kim Jong-un’s North Korean financial system in that the central bank and commercial banks have distinct features in terms of organization and functions. There has been a significant change in the currency circulation structure within the context of the traditional socialist planned economy.

Seeking for Financial Changes to Normalize Public Finance and

Promote Market Economy Based on IT Development

Then, why did North Korea make such changes in its financial sector? The first reason is to normalize North Korea’s public finance function. The second is to fulfill the need for necessary changes in the financial system to pave the way for smooth operation of market economy factors that had been introduced to other economic sectors.

High inflation, greater dollarization, and the development of informal finance are crucial issues high up in North Korea’s list of financial priorities. These problems resulted from cash leaks caused by progress in marketization and lack of trust in the official finance system. Without a doubt, they hinder official banking from functioning well. With advancements in marketization, North Koreans purchased goods in local markets rather than national markets; companies preferred cash that they could use for payments at market prices. This led to greater cash leaks and currency distributed on the market could not be retrieved. This led to chronic inflation. In addition, a lack of trust in the banks, especially after the failure of the 2009 currency reform, has led to severe dollarization. Foreign currencies were favored in storing and trading money. As a result, circulated cash could not be recovered and banks were unable to perform their basic functions as a central bank or financial intermediaries. This is the leading cause behind developments in private finance and the marginalization of public finance. In this regard, North Korea’s recent changes that allow companies to hold and settle cash through checking accounts and encourage residents to use electronic payment cards in essence, incentives to collect funds within the system and normalize public finance functions.

The second reason is to promote market economy features. After Kim Jong-un took power, there has been greater autonomy in production planning and sales in firms and corporates. At this point, Pyongyang authorized price liberalization in sectors where features of a market economy were introduced. In order for this measure to bear fruits, payment methods based on “cash” and deposit currencies, rather than “non-cash” methods that lack purchasing power were necessary. In other words, North Korea sought changes in money distribution and payment methods to ensure the operation of market economy factors introduced throughout the economy.

On the other hand, the development of IT has made it possible for the regime to monitor the overall economy, which pushed for changes in monetary finance. In the past, socialist planned economies such as North Korea tried to oversee corporate production performances through money flow. In this context, they adopted a mono-banking system and distinguished currency circulation and payment methods by “cash” and “non-cash” methods. However, with the development of IT, it has become possible to monitor the overall economy, including inter-corporate payments based on deposit currencies. High technology has made it less essential to adhere to the mono-banking system. Socialist countries in the past had to maintain non-cash currencies for a long time in their pursuit for economic reform. In contrast, North Korea was able to achieve this due to technological development.

The Need to Expand the Level of Reforms and Build Trust for the

Effective Development of the New Financial System

The Kim Jong-un regime had managed leap forward in its economic reforms by laying the foundation for a two-tier banking system. However, it seems that the commercial banking system is malfunctioning and the reforms have had limited effects in inducing the growth of the financial system. Why?

First, commercial banks do not function as financial intermediaries. North Korea has an extremely low savings rate due to the pervasive discredit among people towards the bank. Corporates prefer cash and most of the corporate loans will likely be withdrawn without being re-deposited later; corporate deposits are therefore significantly small. According to studies in North Korea, personal savings account for most of the banks’ loan resources. From this, we can infer that North Korean banks are small in size in terms of loan resources due to the low savings rate. The small size of deposit receipts entail that commercial banks can only play a limited role as fund broker. This restricts them from creating credit.

Second, the structural and institutional constraints within the socialist planned economy, including limited reforms and confined privatization, hinder commercial banks’ development. Partial price liberalization would only make corporates prefer cash more. Cash leaks will continue, adversely affecting commercial banks’ efforts to form funds. Furthermore, North Korea underperforms in terms of privatization compared to other economic reforms. This impedes the development of commercial banks because bank funds could not be connected to investment.

Therefore, in order to improve the effectiveness and development of the modified financial system in North Korea, Pyongyang must consistently promote the overall level of reforms, such as price liberalization and privatization. Above all, efforts to build public financial trust by demonstrating the consistent direction of reforms and providing more opportunities for financial transactions are critically important.■

[1] Donjari is a North Korean term for bank accounts. In the past, corporates were only able to open basic accounts that only had a payment settlement function. However, they have recently been allowed to open Hyeongeum-donjari, which are cash accounts that allow cash withdrawal, remittance, and saving.

[2] Promoting economic reformation while maintaining a planned economy was an experience not only exclusive to North Korea, but also seen in the former Soviet Union, Hungary, East Germany, and Yugoslavia in an attempt to overcome the inefficiency of the planned economy.

[3] However, this does not mean that the two-tier banking system actually function as commercial banks, but indicates that a transition has been made from an institutional point of view.

[4] Kim, Minjung and Sung Min Moon. 2021. “Changes in North Korea’s Financial System During the Kim Jong Un Era: Based on North Korean Literature.” BOK Economic Studies 2021-6. Bank of Korea.

■ Minjung Kim is an economist in the Economic Research Institute at Bank of Korea. She has received her Ph.D. in the Department of Economics at Seoul National University. Her research interests include North Korean economy and transition economy. Recently she published papers on the estimating long-term economic growth or capital stocks in North Korea.

■ Typeset by Seung Yeon Lee, Research Associate

For inquiries: 02 2277 1683 (ext. 205) | slee@eai.or.kr